20 Years of China's Internet——A New Round of Bubbles Is on the Way or Has Arrived

Author:rain

Time:2020/01/10

Reading: 3739

Author · The World Source of Magic Iron · Jointly produced by Tencent News and The World of Magic Iron (WeChat ID: jiangpeiyu0916) ▼ […]

Author · The World of Magic Iron

source · Jointly produced by Tencent News and The World of Magic Iron (WeChat ID: jiangpeiyu0916)

▼

Time is slowly flowing towards 2020. In a blink of an eye, it has been 20 years since mankind entered the 21st century.

20 years, in the long river of human history, is just a fleeting wave, but for the rapidly iterative Internet industry, it is like an endless scroll, full of legendary stories and classic products.

Since the bursting of the Internet bubble and the collapse of NASDAQ in 2000, the global Internet industry has experienced a short period of pain, and has entered the legendary journey of the Cambrian explosion of life. New business models such as the economy have been born one after another, and new technologies such as AI and blockchain have emerged one after another.

Behind this series of changes, the stock prices of technology giants such as Apple, Microsoft, and Amazon have hit new highs.Correspondingly, in the list of the top 100 global market capitalization companies in 2018, technology has become the industry with the largest market capitalization in the list for the second consecutive year, reaching a market capitalization of 4.8 trillion US dollars;The Hurun Research Institute released the "2019 Hurun Global Unicorn List" in October last year, with a total of 494 companies on the list, which means that at least 494 companies have a market value of more than US$1 billion... Such a grand occasion, Can't help but pull our thoughts back to 20 years ago.

01

2000:Nasdaq crashes

The three major portals bleed into the market

On February 4, 2000, it was the Lunar New Year, the most important holiday for Chinese people, and the day of family reunion. Sohu CEO Zhang Chaoyang was nestled in the office of Guanghua Changan Building in Beijing, watching Sohu’s performance on Nasdaq (Nasdaq) over and over again. ) listed files.He watched it almost all day.

At 5 p.m., Zhang Chaoyang finally decided to go public, and pressed the button on the computer to send a listing application to the US Securities Regulatory Commission.From this moment, Zhang Chaoyang fell into a state of anxiety.

At this time, on the other side of the Pacific Ocean, the dot-com bubble reached its climax. As long as you have a hype entrepreneurial idea, you can easily raise a large sum of money, and the company's valuation will become an astronomical figure.For example, a company called Pets.com, whose business model is to sell cat litter online, easily raised $100 million in funding.Jeff Yang, founding partner of Redpoint Ventures, described the madness at the time:The bolder the startup idea, the more dollars it brings in.

On March 10, 2000, the Nasdaq stock index reached its peak of 5132 points, but the "bubble" will eventually burst.With the deterioration of the financial situation of various Internet companies and the disclosure of financial fraud and cashing out of executives, the negative sentiment in the stock market began to spread.

On April 3, 2000, the Microsoft monopoly case was pronounced, announcing that the concept of "market size" pursued by the new economic model may be illegal, which led to a subsequent stampede in the Nasdaq market. Due to the investment leverage function of Nasdaq, It accelerated the bursting of the Nasdaq bubble.Cisco's stock fell 90%, and Microsoft's biggest drop in a single day.In the next two years, the Nasdaq stock index fell from 5100 to 1100, and the price-earnings ratio dropped sharply from 78 times in 1999 to 23 times in 2012.

Of course, the reason why Zhang Chaoyang is anxious is not because he foresees that the Nasdaq bubble will burst, but because of the competitive pressure from Sina and Netease.At that time, in the ranking of the three major portal websites in China, Sohu, which started the earliest, was ranked behind Sina and Netease, and the competition between the three became fierce.

In particular, Sina led by Wang Zhidong made Zhang Chaoyang very nervous.Before Sohu went public, it only raised a total of more than 40 million US dollars, of which more than 30 million US dollars was for the express train of Sohu's listing, which was squeezed in in December 1999.That is to say, the amount of financing used by Sohu for development before is actually only 10 million US dollars, which is less than 1/10 of Sina.What worries Zhang Chaoyang is that Sina already has abundant funds. If it goes public ahead of Sohu, it will be even richer. It is inevitable that large-scale mergers and acquisitions will further widen the gap with Sohu.

On April 14, 2000, Sina was successfully listed, but it did not immediately launch large-scale mergers and acquisitions as Zhang Chaoyang expected.A worse situation came around—the Nasdaq index was getting lower and lower, which made Zhang Chaoyang nervous again.In hindsight, this was the beginning of the dot-com bust.As the Nasdaq slipped into the abyss, Silicon Valley dreamers found that the good times when only bold and bizarre ideas could attract millions of dollars in venture capital were gone forever, and more and more companies were closing their doors.

After some hard work, Sohu finally went public on July 12, 2000, but it shed a lot of "blood": the listing price was lowered from US$15.5 per share to US$13 per share, a decrease of 100 million Fortunately, it did not fall below the issue price on the first day of listing.NetEase, which went public on June 30, was not so lucky. On the first day of listing, it fell below the issue price of US$15.5 per share, a drop of nearly 20%.Sina, which was listed first, only rose a little over 20% that day. Although its performance was worse than expected, fortunately, there was not much "bleeding".

But the dot-com bubble finally began to spread to China Internet million companies.In mid-2001, the New York stock market was devastated, and the stocks of the three major portals fell like waste paper:The stock prices of Sohu and Netease fell to as low as US$0.52 per share, while Sina was slightly better, with the lowest price at US$1.02 per share.

Now it seems that if the three major portals did not go public in 2000, they might not survive in 2002, because they are short of money. Will freeze and starve to death in winter.Because the cash flow of ChinaRen was about to dry up, CEO Chen Yizhou had to sell the company at a low price to alumnus Zhang Chaoyang within 20 days.

More importantly, the successful listing of the three major portals had a profound impact on the development of China's Internet industry. Wang Zhidong, Zhang Chaoyang and Ding Lei demonstrated another way to open up life for the Chinese at that time:Found an Internet company, attract venture capital, go public in the United States, become a business tycoon, and reach the pinnacle of life.

The wealth effect generated by the listing of the three major portals has attracted more funds and talents to enter the Internet industry.At that time, Alibaba, Baidu, and Tencent, the most important Internet companies in China, were founded not long ago, and the longest time was less than two years. However, the small waves in these private economies grew up completely relying on the power of the market, and eventually evolved into The wave of IT reshaping the Chinese economy.

02

Year 2003:International Internet Giants Collective

Landing on the beach in China

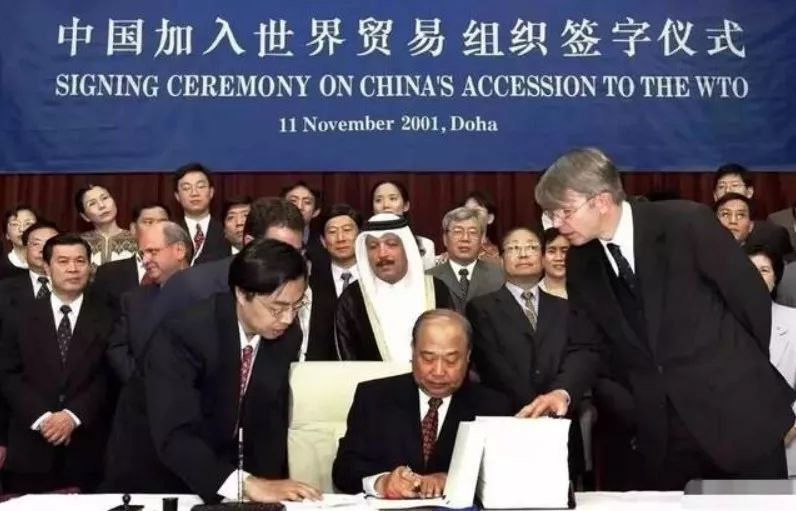

On December 11, 2001, China joined the WTO.For the Chinese Internet industry, this is definitely a major event.Previously, venture capital was the main channel for foreign capital to intervene in China's Internet. With the collapse of Nasdaq in 2000, venture capital from Silicon Valley ebbed. So the investment power came across the ocean.

Around 2003, the Internet giants in Silicon Valley survived the most difficult time one after another. Yahoo, eBay and others repelled waves of hostile takeovers through the "poison pill" plan, and their stock prices began to rise.At the same time, NetEase and Sohu began to bid farewell to the ranks of junk stocks, and their stock prices returned to above $1 per share. The "Chinese concept" became very popular.At the general meeting of shareholders, Internet giants often face questions from shareholders:What plans does the company have for the Chinese market?What have you done in the Chinese market?

Under pressure, the giants began to seriously think about how to seize the gold rush opportunity in the world's most populous country.

At that time, computers were still a luxury for Chinese people, and the main way to access the Internet was through dial-up telephone lines. You could only choose between calling and surfing the Internet, and the speed was only 56Kbps.Despite the backward network infrastructure, China's Internet users are growing rapidly.According to CNNIC data, the number of domestic Internet users was 22.5 million in 2000, and reached 86.3 million in 2003, an increase of 2.84 times in 4 years, the fastest growth rate in the world.

At the same time, China's local Internet companies are not yet profitable, and everyone is still competing to burn money. The market is in a period of brutal growth. For American Internet giants, it is the best time to quickly deploy the Chinese market through acquisitions:

In June 2003, eBay fully acquired EachNet founded by Shao Yibo for US$150 million;

In November 2003, Yahoo announced the acquisition of the 3721 company founded by Zhou Hongyi for US$120 million;

In August 2004, Amazon acquired Joyo.com founded by Lei Jun and Chen Nian for US$75 million;

In addition to acquisitions, Internet giants have also directly landed on the beach through joint ventures or open semicolons:

In May 2005, Shanghai MSN Company announced the cooperation with nine Chinese local enterprises to officially launch the MSN Chinese website and MSN Messenger instant messaging label service, marking the official entry of Microsoft MSN services into China;

In July 2005, Google announced the establishment of a China R&D center, and Li Kaifu was appointed as the president of China;

So far, in just three years from 2003, almost all American Internet giants have rushed to land in the Chinese market, covering mainstream industry sectors such as portals, e-commerce, social networking, and search, forming a confrontation with local Chinese Internet companies and competing for the market. Then it exploded.

From all perspectives, in the face of the attack of international Internet giants, local companies have no chance of winning:

In terms of business model, domestic Internet companies mainly imitate the American Internet giants, and can find corresponding "American teachers" in almost every industry, the most obvious is the portal website, and even the size of the banner advertisement (Banner) was completely copied in the early days;

In terms of operating strength, the vast majority of domestic companies are still newcomers who have not yet made a profit, and the "American teachers" have either completed their internationalization journey and become the industry hegemony like Yahoo, or they have been operating for many years and have deep roots like Microsoft;

In terms of talent pool, very few graduates from TOP10 colleges were willing to enter domestic Internet companies at that time, and getting an offer from a foreign-funded company was equivalent to winning a golden job. Microsoft’s school recruits, and the resumes received by TOP10 college graduates can pile up into mountains, and the scene is as crowded as stars. Meeting with fans.

More importantly, in terms of business environment, domestic Internet companies do not have policy support or financial subsidies, and there is no rigid requirement that Chinese capital must hold at least 51% shares in the industry. Foreign capital can gallop freely in the domestic Internet market.However, in this battle of disparity in strength, the international Internet giants that seemed to be winning were completely defeated.

03

2007:The contest between "student" and "teacher"

On July 18, 2019, Amazon China officially stopped providing seller services for third-party sellers, and only retained businesses such as global store opening, overseas shopping, cloud computing and Kindel in China.In other words, Amazon only keeps a few "observation posts" in China, and the large forces have withdrawn from China.

MSN withdrew from China in 2014, and Yahoo China stopped providing information, community services and email services on September 1, 2013, and then closed its music search service and other businesses.eBay withdrew from the Chinese market around 2010.

In fact, "American teacher" has also had a halo in the Chinese market:

After eBay acquired eBay, it occupied more than 90% of China's C2C market;

MSN occupies the domestic high-end social networking market and officially entered the Chinese market. In just 4 months, the number of users has increased by 25%, becoming a standard tool for business social networking;

Joyo Amazon had the highest B2C market share in 2008, second only to JD.com, and ranked second in China;

Yahoo is the worst performer in the Chinese market among all the Internet giants, but in 2004 under the leadership of Zhou Hongyi, it still earned 10 million US dollars, and its profit performance surpassed the three major portals;

However, the Internet giants did not last long. Under the attack of domestic Internet companies, their market advantages quickly collapsed. Just entering 2007, the Internet giants showed that their defeat was doomed with the collective escape of Chinese executives.Taken together, Yahoo China and eBay's EachNet were completely defeated in just over 3 years, MSN persisted for about 5 years, and Amazon lasted for more than 12 years.

Why do Internet giants fall into the "localization curse" without exception in the Chinese market?The superficial reason is that the Chinese market is fiercely competitive, but behind it is the overwhelming sense of superiority of the "American teachers" who underestimated the determination of the "Chinese students" to resist.

Nowhere is this more evident than in Yahoo and Amazon.

Although Yahoo acquired the 3721 website in 2003 and aggressively entered the Chinese market, it actually began to test the water as early as 1998, and cooperated with Founder Group in 1999 to establish Yahoo China to officially enter the Chinese market.At that time, the three major domestic portals were glamorous on the surface, but lacked a clear profit model on the inside. Because too much money was burned and cash flow was tight, they were eager to embrace Yahoo's thigh.“If Yahoo put down its airs and cooperated with Sina, perhaps the story would have been rewritten." Wang Zhidong, the founder of Sina, recalled the scene at that time.But Jerry Yang, the boss of Yahoo, chose to sit on the sidelines and wait for the "Chinese students" who followed suit and imitated him, and waited for them to burn their money before harvesting.

Yahoo's sense of superiority also makes it ignore the feelings of Chinese users.The first general manager of Yahoo China was Zhang Pinghe. His duty was neither to fight against Chinese competitors nor to study market pain points, but to copy Yahoo’s global success model to China. As a result, Yahoo China became a localization of Yahoo’s website Version:News Channel is the Sinicization of Yahoo America, Yahoo Mail, Yahoo Messenger, Yahoo Photo Album, Yahoo Briefcase, Yahoo Chat Room, etc. are all the Sinicization of Yahoo America.

As for the news supermarket, which is the favorite of Chinese users, Yahoo turns a blind eye and only arranges a few people to maintain the news channel, while domestic portals such as Sina, Sohu and Netease arrange editors ranging from hundreds to thousands of people to operate news in an assembly line Channel, leaving Yahoo far behind with massive news information.

Amazon, who arrived late, almost fell again in the struggle that Yahoo had fallen to varying degrees:The page on the PC side of China is old-fashioned, and AmazonThe US page is the same, and compared with Taobao, Tmall, and JD.com, it is less attractive;When the era of mobile Internet came, "Chinese students" imported traffic into mobile APPs and provided information streaming services, but Amazon simply transplanted PC-side content to APPs, lacking ecological content;Amazon stubbornly chose to stick to the factors that affect the experience, such as search and classification, which users complained about.

Perhaps, Amazon believes that as long as the products it provides are cheap enough and of good quality, the customer experience will naturally improve, and Amazon disdains the marketing method that Chinese e-commerce companies like to use like price wars.However, when Amazon's important differentiated advantages such as "same-day delivery" were equaled by JD.com's "211 limited-time delivery", and "overseas shopping" and "global store opening" were caught up by Tmall and JD.com, Bezos's Chinese semicolon Falling into the embarrassment of "everyone has me and nothing", the living space becomes more and more cramped.

There are different opinions on why the "American teacher" lost to the "Chinese student", but one thing is certain, the Chinese market is just a pawn in the global game of chess for the Internet giants. ;For domestic Internet companies, the local market is related to the entire family and life, so they had to fight with their backs, and ended up living to death.

After this battle, domestic Internet companies have found their confidence, quickly caught up with the wave of mobile Internet, and stood on the same starting line as the "American teacher". Internationalization synchronization.

04

Year 2008:Android and iPhone on

mobile internet era

On January 9, 2007, at the Macworld conference in San Francisco, Apple CEO Steve Jobs held the best product launch event in his life.After some careful planning, Jobs introduced the upcoming blockbuster new product:"Today, we're launching three...revolutionary products.The first was the widescreen touch-enabled iPod, the second was a revolutionary cell phone, and the third was a breakthrough Internet communications device.Probably afraid that the audience would not be impressed, Jobs repeated this sentence again, and finally shook out the burden:"It's not three separate devices, it's one device, and we call it the iPhone."

After the iPhone was released, it was quickly sought after by bloggers as the "Jesus Phone", which means the mobile phone that changed the world.But Apple's competitors are unanimously pessimistic. Nokia bluntly said that the iPhone will not succeed, and Microsoft dislikes it for not having a keyboard.

In the first year of release, the performance of the iPhone can only be said to be unsatisfactory, selling 1.387 million units, but after the release of the iPhone3G in 2008, it sold 11.627 million units that year, beating all competitors.

In November 2007, a landmark event occurred: Google and 84 hardware manufacturers, software developers and telecom operators formed the Open Handset Alliance to jointly develop and improve the Android system.Subsequently, Google released the source code of Android under the authorization of the Apache open source license.The first Android smartphone was released in October 2008.

The advent of Android and iPhone brought mankind from the PC era to the smartphone era in 2008. This is not just a revolution in the form of computers (computers have changed from bulky desktops to small things that can be carried in pockets), but a kind of The birth of a new way of obtaining information (smartphones allow network connections to move with people's movement), and the era of mobile Internet has begun.

In China on the other side of the ocean, also in 2008, the issuance of 3G licenses marked the implementation of mobile Internet infrastructure, and China also entered the mobile Internet era together with the United States.

For China's Internet industry, a new reshuffle opportunity is coming.

Under the surging trend, Beijing has a pair of eyes closely watching Jobs' every move.Nearly 20 years ago, in 1990, he accidentally found a copy of "Fire in Silicon Valley" in the university library, and the legend of Jobs described in the book deeply attracted him.Since then, Jobs has become his idol. After Jobs returned to Apple in 1997 and made great achievements again, he carefully studied the idol's product design concept, business strategy and marketing style, and wrote "What's in the Mind of Apple CEO Jobs", " Analyzing the Great Genes of Apple and Google" and other blog posts summed up the entrepreneurial eight-character formula of "focus, extreme, word-of-mouth, and fast".

He was Lei Jun, the founder of Xiaomi Technology.

At that time, Lei Jun had just left Jinshan, where he had served for many years, and was at home. Without the hustle and bustle of the media, and without the star-studded work life (Lei Jun was called a "Zhongguancun model worker" by the industry), he found that he was about to be forgotten by the world.After two years of retreat, Lei Jun chose to start again and founded Xiaomi Technology in April 2010.

The emergence of Xiaomi detonated the domestic smartphone industry, and the number of Internet mobile phone brands following Xiaomi's concept reached more than a hundred at the peak.Of course, most of these brands have failed, but they have completed the market education for the popularization of smartphones and accelerated China's switch from PC Internet to mobile Internet.

In 2008, the year before Lei Jun’s retreat, that is, in 2007, another landmark event occurred, that is, the decisive battle between local Internet companies and multinational Internet giants mentioned above has been decided.

The defeat of Internet giants in the Chinese market has had three far-reaching effects:

The first is to enhance the business confidence of domestic local Internet companies. It is said that when a local Internet giant landed on a strong opponent, the management once panicked. .More importantly, due to the victory over multinational giants, the attractiveness of local companies to talents has been greatly enhanced. Foreign-funded companies are no longer the best employment choice for outstanding college graduates, and the balance of competition is gradually tilting towards local companies.

The second is that local Internet companies can perfectly enjoy China's huge demographic dividend, enabling the country to cultivate world-class Internet giants. Before 2010, almost all of the world's top 10 unicorn companies were taken over by Europe and the United States. After 2010, Chinese unicorn companies Gradually entering the global TOP10, Meituan, Didi, Toutiao, etc. were all established after 2010.

The third is that local Internet companies have smoothly switched to the era of mobile Internet.According to the data released by CNNIC, 2008 and 2009 are the key time points when the center of the Internet shifts from PCs to smartphones. The proportions of mobile phone users in China increased by 64.6% and 53.4% respectively, as shown in the statistical line chart. A steep, upward straight line, like a spectacular wave, and this wave has only appeared once in the past 20 years.If local Internet companies do not have a successful foundation in 2007, they will miss this wave of mobile Internet.

05

Year 2014:"Super App" Innovation Explosion

If the United States is a country on wheels, then China can now be said to be a country above smartphones, because China is not only the world's largest smartphone producer and consumer, but also the country with the most developed mobile Internet applications in the world.

If you take "what will happen on the Chinese Internet in a certain minute in 2018" as the dimension of investigation, you will find how huge the volume of the Chinese Internet is. According to the relevant information:In one minute, more than 96,000 online shopping packages were sent, about 14,136 taxi service orders were received on Didi, 3.125 million messages were sent on WeChat, and another 284,700 audio calls were made successfully.Benefiting from the huge capacity of China's online market (as of June 2019, the number of Chinese netizens was 854 million), local Internet companies have gradually developed into industry giants:E-commerce giant Alibaba, online social service giant Tencent, ride-sharing platform Didi, life service e-commerce Meituan Dianping, etc.

These giants have profoundly changed the way of life of ordinary people.

As the largest e-commerce platform in China, Alibaba has turned "Double 11" into an annual online shopping carnival.According to official data from Tmall in 2018, the total turnover of "Double Eleven" exceeded 10 billion yuan in 2 minutes and 05 seconds after the opening, breaking the record of breaking 10 billion yuan set last year;In less than 15 hours and 50 minutes, the total turnover exceeded last year's full-day turnover;In 2018, the total turnover was rated at 213.5 billion yuan, which was the first time since the inception of "Double Eleven" that it exceeded the 200 billion yuan mark.Due to the huge influence of "Double Eleven", American consumers have also joined the ranks of "chopping hands". According to data from Adobe Analytics, American consumers' spending on "Double Eleven" in 2018 reached 1.82 billion US dollars.

The development of e-commerce has made China the most developed mobile payment application country in the world. The transaction volume in 2018 was about 180 trillion yuan, which was about 8 times the mobile payment transaction volume in the United States that year.It can be said that due to the market influence of Alipay and WeChat Pay, China has entered a cashless society in just a few years, far faster than Europe, America and Japan.

Super apps belong to the innovation explosion of domestic Internet companies in the era of mobile Internet. Various functions such as social networking, life services, finance, payment, and content information are integrated in one app, which enriches the attractiveness of the app and enhances the appeal of the app. user stickiness.

Mary Meeker, a famous female venture capitalist known as the "Queen of the Internet", believes in the 2019 edition of the "Internet Trend Report" report that a series of mobile Internet developments in China, including WeChat and Meituan Dianping, have emerged. "Super app" is an innovation and has been used for reference around the world, including shared travel companies Grab and Uber, which have launched similar comprehensive application services.

The innovation of "super application" has made China's mobile Internet reach the height of the global industry.All of this is inseparable from laying foundations in the 3G era and building tall buildings in the 4G era.The 3G era has laid two foundations. The first is that although the progress of 3G network infrastructure construction is slightly behind that of Europe and the United States, the network covering the whole country covers more than 1.3 billion people. At the same time, the developed smart phone manufacturing industry has turned these 1.3 billion people into Huge market of 1.3 billion users;The second is the BAT-based Internet ecosystem that covers all aspects of personal clothing, food, housing, and transportation, fully meeting the needs of 1.3 billion users.

In 2013, China officially commercialized 4G. One year later, in September 2014, the government officially proposed "mass entrepreneurship and innovation" to set off a new wave of "mass entrepreneurship" and "grassroots entrepreneurship" on 9.6 million square kilometers of land. Form a new trend of "innovation by all" and "innovation by everyone".This policy has had two impacts. On the one hand, many people start their businesses in the Internet industry first, and makerspaces are blooming all over the country. On the other hand, the Internet industry has penetrated into all aspects of the economy in the form of "Internet+", and the traditional economy has been transformed by the new economy.

The result is that China's Internet has found a new evolutionary direction, which not only helps "Industrial Manufacturing 4.0", smart home, smart hardware, AR/VR and other hardware to lay nerves, but also develops innovative advantages such as sharing economy and mobile payment, so that China has become an Internet powerhouse that keeps pace with the United States.

However, behind the continuous wealth creation of China's Internet industry is the extremely fierce market competition. Words full of gunpowder such as "red sea" and "blood sea" often linger on the lips of Internet entrepreneurs.The most typical performances are webcasting and shared bicycles.

With the gradual rise of the 4G network, webcasting broke out in 2015, and broke into the public's field of vision with a wild horse galloping in 2016, becoming a form of mass entertainment that can satisfy both refined and popular tastes.On April 23, 2016, Lei Jun, the founder of Xiaomi Technology, made his live broadcast debut. In addition, the major entertainment stars at that time frequently became regulars of webcasting, and the development of the webcasting industry entered a hot period. By the end of the year, a total of 31 online live broadcast platforms across the country had completed 36 financings, involving a total amount of 10.832 billion yuan. The industry was so hot that Internet companies would be ashamed to say that they were playing the Internet if they had nothing to do with live broadcasting.

However, due to fierce competition among live broadcasting platforms, coupled with gray operations and excessive hype, in just one and a half years, the entire industry has entered a period of freezing, and the lively "Thousand Broadcasting War" has become "Thousand Broadcasting Bankruptcy".The duration of online live broadcasting is far lower than the 10 years of smartphones, making it the industry with the shortest life and worst quality.

In contrast, shared bicycles, a representative of the sharing economy, have fallen on the business model.Shared bicycles are called one of the "Four New Chinese Inventions" by foreign media. Its biggest pain point is the high man-made damage rate (online surveys show that the damage rate is 30-40%), which not only greatly shortens the normal service life of bicycles, but also forces Start-up companies deploy a large number of operation and maintenance personnel, which pushes up operating costs and eats up gross profits. It is difficult for the company to make profits, and it cannot survive without continuous capital transfusion. This is the fatal flaw of the shared bicycle business model.By 2017, business difficulties have become an industry problem for shared bicycles, and even leading companies feel that they are struggling.As of December 2017, Mobike held 3.752 billion yuan in cash, owed suppliers 1 billion yuan, and misappropriated user deposits of 6 billion yuan.In addition, Mobike's monthly operating expenses exceeded 400 million yuan. In December 2017, its monthly revenue was 110 million yuan, and its monthly net loss was nearly 300 million yuan.

Probably seeing the flaws in the business model of shared bicycles, Hu Weiwei, the founder of Mobike, sold the company to Meituan on April 3, 2018, and cashed out.Dai Wei, the founder of another leading company ofo, chose to persevere. The result was that the company went bankrupt, and the former entrepreneurial hero became an old man.

The two people's completely different life experiences inevitably make people sigh.

After spending a lot of money on trial and error, the sharing economy and webcasting have returned to rationality from the hustle and bustle, and they have found their place in the Internet industry chain again. Among them, webcasting has become a kind of online service, integrated into many super applications, and set off a new era of consumption. With the trend, more and more Chinese consumers have begun to accept "live delivery of goods", which has given birth to a group of hot e-commerce live streaming Internet celebrities such as Wei Ya and Li Jiaqi.Among them, Li Jiaqi, known as the "Prince of Lipstick", sold lipsticks with Ma Yun in a Taobao live broadcast event. Within 5 minutes, Li Jiaqi sold 1,500 pieces, while Ma Yun, the boss of Taobao, only sold 10 pieces. , the traffic monetization ability and network influence of super network anchors can be seen.

06

2020:A new round of Internet bubble coming?

On the Internet, netizens often ask:Why are there no Internet giants in Europe, India and Japan?

The answer is actually not complicated. There are abundant funds, a large number of elite talents, a unified and huge market, and a strong entrepreneurial culture.

Although Europe has a population of nearly 800 million, it does not have a strong entrepreneurial culture and venture capital capital is not developed. Japan has a population of less than 130 million and suffers from an aging population, and its market size is too small. Elites are lost to Silicon Valley) and capital are not dominant.

China's initial and biggest advantage is that it has a unified and huge market, so every time an Internet entrepreneurial opportunity comes, it can always give birth to a unicorn-level company in a short period of time.Around 2015, after short videos became popular, Kuaishou users increased by 300 million in just over two years.Similarly, another short video platform Douyin has achieved explosive growth in just over 2 years.As of the end of May 2019, Kuaishou’s DAU exceeded 200 million, Douyin’s DAU exceeded 300 million, and the valuations of both companies exceeded US$20 billion.In a country’s regional market, it is already a miracle to be able to cultivate one unicorn company, but China has two unicorn companies in the same industry. In addition to the miracle, the most important thing is the unified and huge population of more than 1.3 billion. market.

Today, growing into a giant or quasi-giant in the domestic market, and then going overseas to complete the international journey has become the standard way for Chinese Internet companies. This is the benefit of China's large market.Only deep water can raise big fish, and big fish can swim in the sea.

A large market is very important, and entrepreneurial culture is also indispensable. After all, Internet entrepreneurship is an adventure game for the brave.

Long before the establishment of the three major portals, Zhongguancun has already gathered the first batch of software companies such as Jinshan, Rising, UF, and Wangma, and cultivated a relatively strong entrepreneurial culture and atmosphere. The soil of business success.

There was a popular saying in Zhongguancun:China's Internet industry did not come out of eight sedan chairs, but came out of a narrow path. Under the circumstances that no one was optimistic about, China's initial Internet industry lacked a sound investment mechanism and no necessary policy preference. The market The legal environment has yet to be improved, but under the guidance of the wealth effect, it is rushing all the way, engulfing the global IT industry, and staged a counterattack drama from "cottage" to leadership, which has become a rare highlight in the development of China's private economy.

After more than 20 years of hard work, China's Internet industry has grown into an important global force, but it has also started an adjustment mode since 2018:

At the beginning of 2018, the hottest blockchain bubble dissipated in less than a year;Artificial intelligence companies have also begun to return to rationality, and start-ups that have received a large amount of financing have collapsed;

Car-sharing platforms have closed down one after another. The operating vehicles are basically all Smart, BMW, Audi and Mini Cooper. The mid-to-high-end shared leasing platform Tuge stopped operations in early 2019. The founder Wang Lifeng was besieged by users and partners. Not many people remember now Tuge this company;

In 2019, the projects of several giants such as Meituan Xiaoxiang Fresh, SF Express, Alibaba’s Hema Fresh, and Yonghui’s Super Species have successively reduced their operating scales. The start-up company Dailuobo raised RMB 600 million in June, was selected as the "2019 Second Quarter Hurun China Potential Unicorn" in September, and was on the verge of bankruptcy in November. Jijixian also received a round A investment from Matrix Partners in May 2019 , At the end of October, it was still frantically recruiting on the official account, and it entered a semi-closed state at the beginning of December, and the number of employees was reduced to less than 300....

This situation is so similar to the Internet bubble burst 20 years ago!This indicates that a new round of bubbles is already on the way or has arrived.