Understanding the Industrial Internet of Things in One Article (2) - A Guide to the Deployment, Vendors and Platforms of the Industrial Internet of Things

While many IIoT projects are still in the proof-of-concept or experimental stages, there are clear signs that they are moving toward full-scale production deployments. At present, relevant technical conditions have been met, investment decisions have been made, and the return on these investments will be predictable.

At present, relevant advanced technologies include 5G, IoT sensor platform, edge computing, artificial intelligence and analysis, robotics, blockchain, additive manufacturing and virtual/augmented reality, etc. The aggregation between them will form a fertile industrial Internet of Things. The development environment, and will usher in the fourth industrial revolution, that is, Industry 4.0.

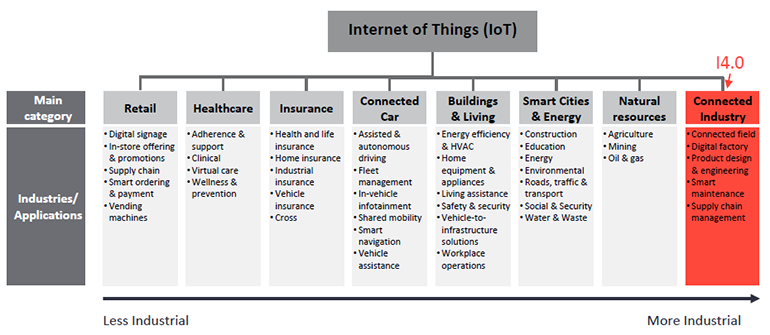

Here’s what IoT analytics firm IoT Analytics has to say about the relationship between IoT and the IIoT 4.0 offshoot:

In this new era, supply chains will have end-to-end transparency thanks to sensors, data networks, and analytical capabilities at key nodes. Other things being equal (such as trade barriers), components and raw materials will arrive at highly automated factories in a timely manner, and the products produced will be tracked throughout their entire life cycle until eventual recycling. Similarly, "smart farms" will integrate emerging industrial IoT-related technologies into high-resolution crop production systems based on robotics, big data, and analytics.

As a result, businesses deploying IIoT systems will see increased operational efficiency, which will reduce their environmental impact, and will have access to better information services to inform future planning.

This is only theory, but what does it look like in practice? This guide examines available information on adoption of IIoT, market size estimates, startup activities, and IIoT platforms.

Who is deploying IIoT solutions?

1. Status of Industrial Internet of Things (PTC)

PTC is a leading provider of industrial IoT software platforms, and the study, published in February 2018, is based on data collected from the company's customer base.

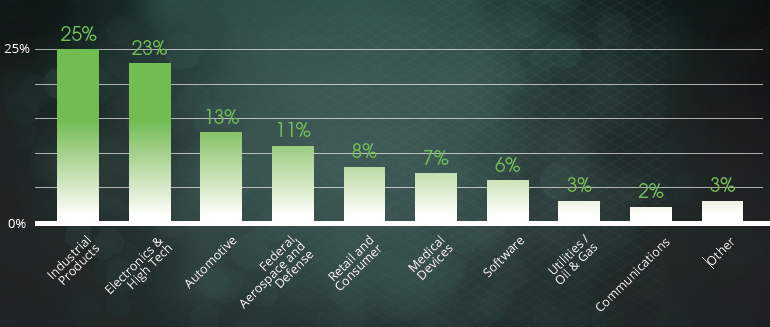

In PTC’s survey, the Americas lead in terms of IIoT adoption (45%), followed by EMEA (33%) and Asia Pacific (22%). The main industries deploying IIoT solutions are primarily Industrial Products (25%), followed by Electronics & High Tech (23%) and Automotive (13%):

According to the report: “These industries are leading the way in IoT due to their complex manufacturing and operational processes, as well as high capital equipment. They benefit greatly from IoT solutions and data-driven insights that can Driving more sustainable, resilient and efficient processes."

The majority of companies adopting IIoT are large organizations (58% with over $500 million in revenue), although a third (31%) are small. Presumably these companies are generally more nimble, companies with less than $100 million in revenue.

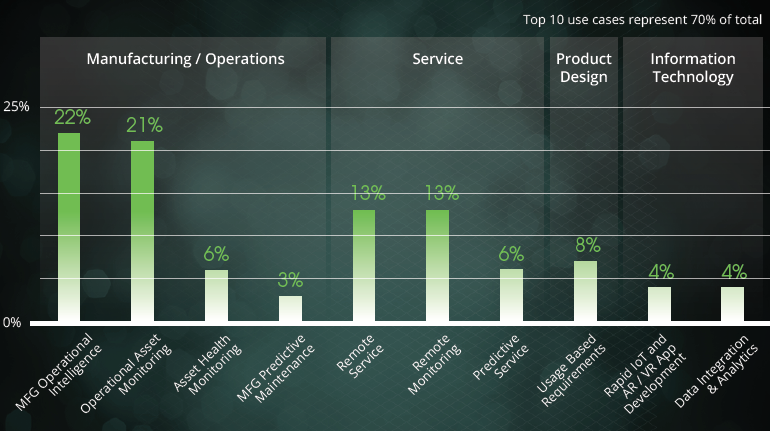

In the PTC survey, IIoT use cases include production/operations, service, product design and IT:

"The most dominant use case is the application of IoT in the areas of smart manufacturing operations and business asset monitoring. These smart, connected capabilities help product manufacturers increase output, improve production quality, and reduce manufacturing costs," the report said.

Industrial IoT deployments generate large amounts of data, and decisions need to be made about where to best store and analyze this data. For example, the PTC report notes that factories and hospitals may favor on-site deployment due to the need for security and low-latency response, while for smart cities, transportation, or the oil and gas industry, the scalability of the cloud may win out. In the PTC survey, on-premises deployments surpassed cloud deployments (62% vs. 38%).

Taken together, PTC states that “the Internet of Things is no longer a wait-and-see technology; companies must act now or risk being left behind.” In the survey, 83% adopters plan to deploy within 12 months Move from proof of concept to full production.

2. Land and Sea Industrial Internet of Things (Inmarsat)

A 2018 study by Inmarsat looked at the adoption of Industrial IoT in the agriculture, energy, maritime, mining and transport sectors (focusing, of course, on the role of satellite connectivity as an enabling technology).

Market researcher Vanson Bourne interviewed 750 respondents who were able to participate in major decisions or have a large influence in the process of industrial Internet of Things initiatives in their organizations, including the Americas, Europe, Middle East and Africa, with at least 500 employees (with the exception of the maritime sector, where organizations with 45% have fewer than 500 employees). The following are the main findings.

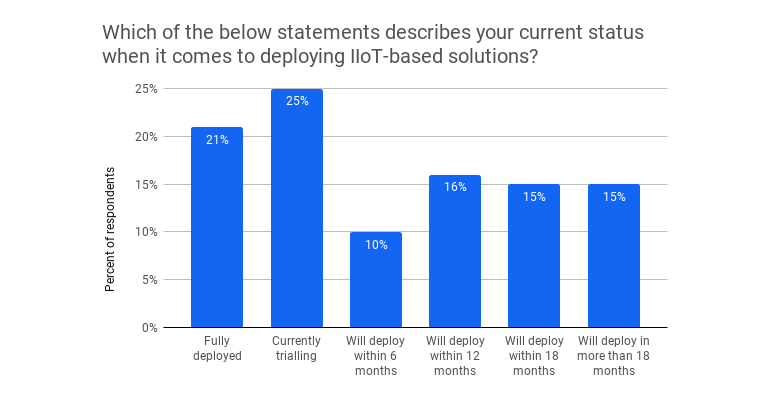

Nearly half (46%) of enterprises reported either fully adopting (21%) or piloting (25%) IIoT solutions, with resource efficiency, health improvement and safety, and environmental change monitoring being the main drivers.

The main barrier to IIoT adoption is skills, followed by a lack of off-the-shelf solutions, higher-than-expected costs and security. Specific skills related to IIoT were identified as lacking in security (56%), analytics/data science (48%) and technical support (42%), with decision-making, management, planning, database administration and customer service also reported.

In terms of security, nearly two-thirds (65%) of respondents believe their IIoT defenses should be stronger, with external cyberattacks, poor network security and employee misuse of data being the top challenges.

Data is key to IIoT-based transformation, and Inmarsat respondents cited cost savings and efficiency opportunities, productivity monitoring, and health and safety improvements as current data-related issues. Looking ahead, better decision-making, better visibility of internal data and better supply chain insights are seen as important potential benefits.

Unsurprisingly, the maritime sector is placing the highest priority on satellite communications (Inmarsat's core business) in its IIoT deployments. Among other connectivity technologies used by respondents, RF and Bluetooth topped the list.

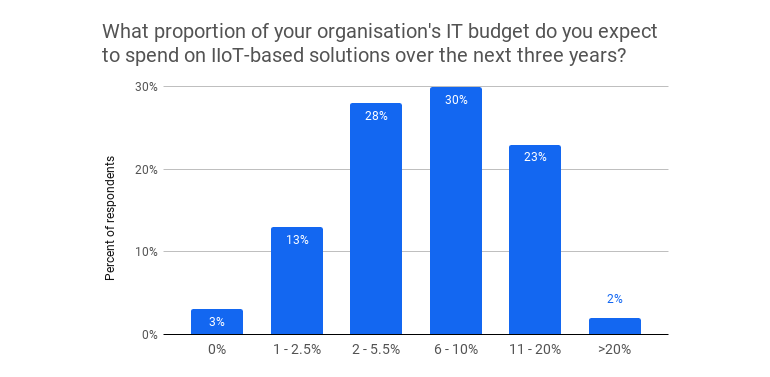

A quarter of Inmarsat respondents expect the IT industry to spend more than $10% on IIoT solutions over the next three years, and the overall expectation is that they will get a good return on investment: “By the end of the year , will be able to reduce the cost of 10% and increase the turnover of 5%. And this benefit will be more in 2023." The report said.

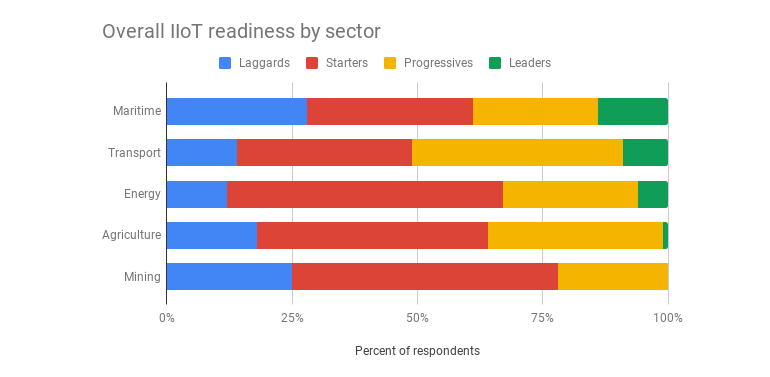

Finally, to assess readiness for IIoT solutions, Inmarsat scored respondents in six key areas (adoption, security, connectivity, skills, data and investment/ROI) and divided them into categories (Laggards, Initiators, Progressives and Leaders). On this basis, the maritime and transportation sector leads in terms of IIoT, with mining at the bottom:

Inmarsat recently announced a partnership agreement with Microsoft, combining the former's satellite communications network with the latter's cloud-based Azure IoT central platform. Data generated by the IIoT infrastructure, wherever it is located, is transmitted via satellite to Azure IoT Hub for analysis. Inmarsat said the collaboration will initially focus on industrial IoT solutions for the agriculture, mining, transportation and logistics sectors.

Industrial Internet of Things Market

Given the number of Industrial IoT core and enabling technologies, and the demand for manufacturing industries of all sizes to keep up with digital transformation or outperform competitors, analysts predict impressive growth for this market over the next few years .

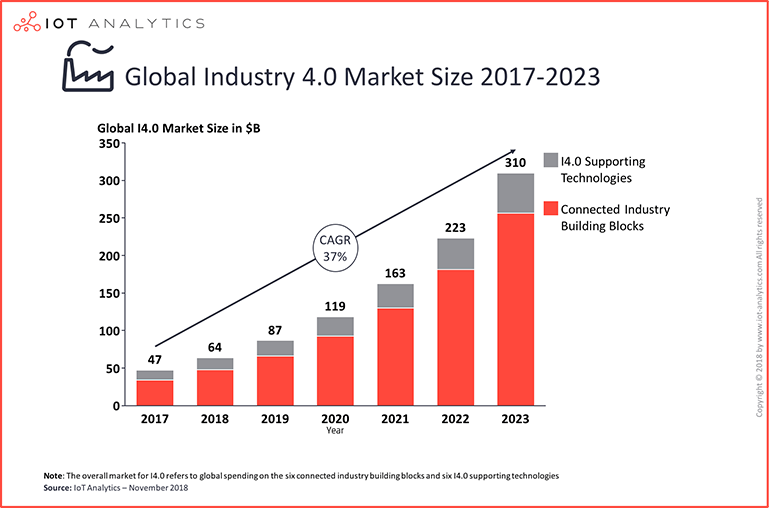

The following is a November 2018 report by IoT Analytics on Industry 4.0 market growth forecasts from 2017 to 2023:

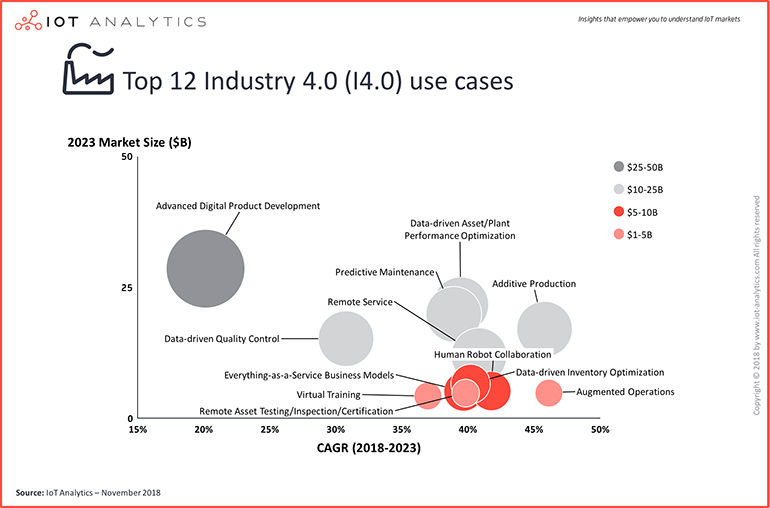

Of the 12 use cases identified by the IoT analysis, the largest market will be advanced digital product development, while the fastest growing between 2018 and 2023 will be additive production (i.e. industrial-scale 3D printing) and augmented business:

In a statement, Matthew Wopata, the report's lead author and chief industrial IoT expert at IoT Analytics, said:

“Advanced digital product development will be the largest use case for Industry 4.0 technologies as companies use additive manufacturing, AR/VR and digital twins to reduce product development costs and time-to-market.” Other large use cases such as data-driven quality control , predictive maintenance and data-driven asset/plant performance optimization will continue to gain popularity as manufacturers use Industry 4.0 technologies to improve their operational KPIs such as OEE (Overall Equipment Effectiveness). Key vendors of Industry 4.0 solutions are highly focused on customer pain points/use cases and ensure that data-driven insights generated from Industry 4.0 solutions lead to measurable improvements and tangible ROI.

Industrial Internet of Things Industry Association

There are many industry associations related to the Industrial Internet of Things, and on January 31, 2019, two major organizations, the Industrial Internet Consortium (IIC) and the OpenFog Alliance, announced their alliance.

The goal of the IIC is to accelerate the Industrial Internet in five areas: Leverage existing technologies or create new use cases and testbeds for real-world applications; Provide best practices, reference architectures, case studies, and standards requirements; Influence Internet and industrial systems Development of global standards; facilitating open forums for sharing and exchanging real-world ideas, practices, lessons learned and insights; building confidence around new and innovative approaches to security.

The OpenFog Consortium's raison d'être is defined as follows: "Our efforts will define an architecture of distributed computing, networking, storage, control, and resources that will support intelligence at the edge of the Internet of Things, including autonomous and self-aware machines, things, devices and smart objects. OpenFog members will also identify and develop new operating models. Ultimately, our work will help drive the next generation of IoT.”

According to the IIC/OpenFog merger statement, "These organizations will work together under the umbrella of the IIC to drive momentum for the Industrial Internet, including the development and promotion of industry guidelines and best practices for fog and edge computing."

“This agreement brings together two of the most important organizations shaping the Industrial Internet of Things. The combined organization has greater influence for members, a clearer market, and lower future risk for end users. We will be the future of Industrial IoT systems center of gravity," said Stan Schneider, CEO of Real-Time Innovations (RTI) and vice chair of the IIC Steering Committee, in a statement.

Other IIoT-related bodies include: Plattform Industrie 4.0, Labs Network Industrie 4.0, OPC Foundation, Industrial Data Space Association, CyberValley in Baden-Württemberg, Center for IoT Technology Development and Application, and Manufacturing USA.

Industrial Internet of Things Platform

The Industrial Internet of Things represents the convergence of operational technology (OT) and enterprise IT systems, with potential benefits of improved asset management and operational visibility. IIoT software platforms need to enable these benefits and interact with enterprise systems, as well as be secure.

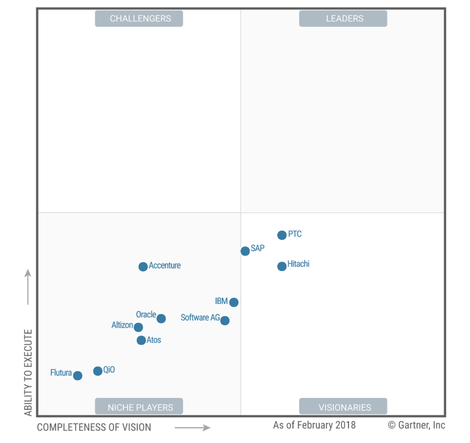

Gartner's first Magic Quadrant for Industrial IoT Platforms (May 2018) requires that "products must function as both cloud IIoT platforms and on-premises deployments." This is surprising because there are several companies with "significant brand equity related to Industrial IoT" - including Bosch, GE Digital, Microsoft, Schneider Electric and Siemens (Siemens) - both excluded from consideration for lack of field parts.

"In short, the culture of industrial engineers is in constant flux with a high level of trust in what they can touch and control," Gartner explained. "The deployment of an internal IIoT platform is fundamental to building trust."

Gartner also requires vendors to "develop, market, and sell Industrial IoT platforms as asset-agnostic, horizontal middleware that can be sold as a standalone product" to "ensure broad availability and usefulness value". This also excludes some large and important manufacturers.

All of this helps explain the sparse nature of Gartner's Industrial IoT Magic Quadrant, and the fact that it doesn't have any entries in the Leaders and Challengers quadrants:

PTC, SAP and Hitachi are classified as visionaries, while the remaining eight vendors - some of the biggest names among them - are considered niche players.

For Gartner, PTC's strength lies in its core applications for product lifecycle management (PLM), computer-aided design (CAD) and service lifecycle management (SLM). The company specializes in solutions for asset monitoring, predictive maintenance and operational excellence.

SAP's Leonardo is a multi-cloud (AWS, Google, Microsoft) platform with independent on-premises solutions. According to Gartner, Leonardo is best suited for SAP customers looking to combine IT/OT with SAP's IoT applications, asset intelligence networks and legacy industry applications.

Gartner said that Vantone Real Estate's Lumada platform is most suitable for the industrial environment of Hitachi equipment. Customers can take advantage of pre-built functions for edge device interaction and ready-made "solution cores" to solve industrial asset monitoring, maintenance, scheduling, quality, safety and productivity needs.

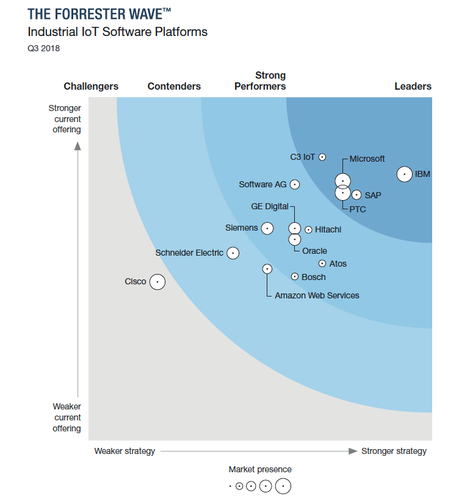

The Forrester Wave: Industrial IoT Software Platforms, Q3 2018 surveyed the industrial IoT platform market with slightly different results.

For Forrester, an IIoT software platform must do five things: (1) create connections between industrial machinery and digital systems; (2) protect IoT devices and data from attacks; and (3) control IoT Supply, maintain, and operate equipment; (4) translate data into timely, relevant insights and actions; and (5) create applications and integrate with enterprise systems.

Forrester differs from Gartner in that it considers public cloud a "must-see":

"Practical considerations of providing connectivity to remote locations, coupled with general skepticism about the security, capabilities, and trustworthiness of startup-obsessed public cloud providers, have led early entrants to the IIoT space to invest in building their own data Centralized networking. Those days are over. All of the vendors evaluated retain some capability for deployment in private data centers, but the direction of progress is clear: They and their customers are moving toward cloud computing.”

Other changes since Forrester first evaluated IoT platforms in 2016 include: user interfaces powered by modern APIs; analytics, coupled with machine learning and artificial intelligence, as a core component; integration with other enterprise systems (ERP, CRM, service desk) increased data flow; digital twins, augmented reality on the horizon; and solutions focused more on use cases such as predictive maintenance.

Forrester included Amazon Web Services, Atos, Bosch, C3 IoT, Cisco, General Electric, Hitachi, IBM, Microsoft, Oracle, PTC, SAP, Schneider Electric, Siemens, and software companies in its evaluation of 15 vendors.

Judging from the current products, strategies and market performance, IBM, C3 IoT, Microsoft, SAP and PTC have become the market leaders:

According to Forrester: IBM's Watson IoT platform offers "broad analytics for specific industries and services." C3 IoT "different from analytics, leaving management of things to partners"; Microsoft Azure IoT "provides cloud-enabled infrastructure and more" - including development tools, advanced analytics capabilities, augmented reality (HoloLens) and edge computing ; SAP Leonardo "includes IoT and other digital innovations" -- featuring machine learning, blockchain, and big data; and PTC "converges device connectivity strength with augmented reality vision."

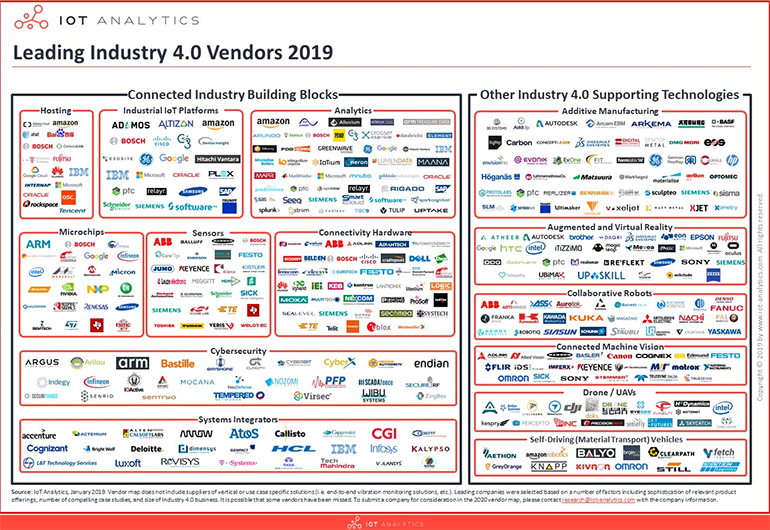

industrial internet of things players

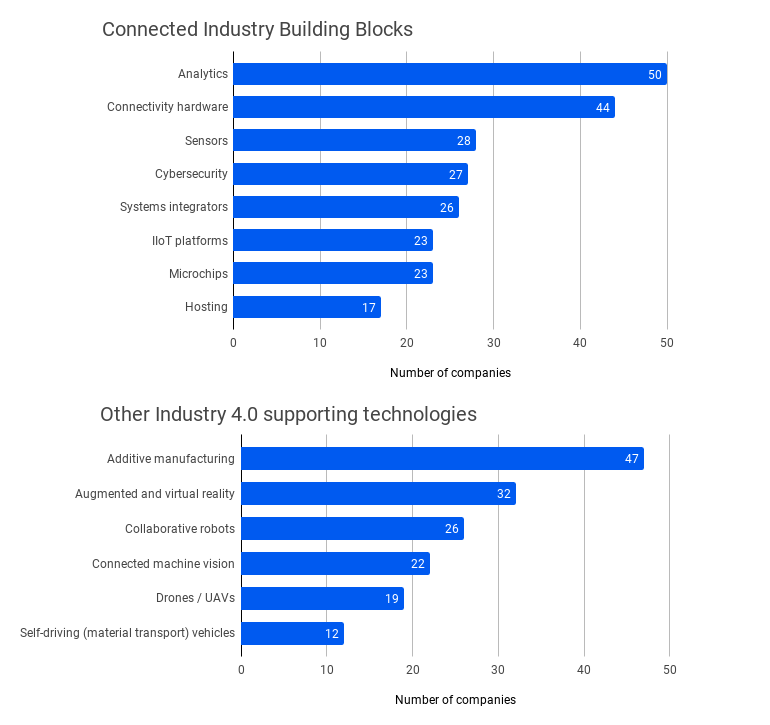

Of course, there are many companies involved in the IIoT ecosystem in addition to software platform vendors. In the Industry 4.0 and Smart Manufacturing 2018-2023 report, IoT analysis identified more than 300 companies providing products and services that are driving the Fourth Industrial Revolution. The analyst firm divides these suppliers into "connected industrial building block" vendors and "other Industry 4.0 enabling technologies" vendors:

Analytics and hardware connectivity lead in the building blocks category, while additive manufacturing (industrial 3D printing) and AR/VR lead in enabling technologies:

Companies highlighted in each category are: Microsoft (colocation); Microsoft, GE, PTC and Siemens (industrial IoT platforms); Absorption (analytics); Nvidia (chips); Festo (sensors); HMS ( Connected hardware); Claroty (cybersecurity); Accenture (systems integrator); General Electric (additive manufacturing); man-machine/drones); and Clearpath Robotics (autonomous [material transport] vehicles).

Digital Twin: An Emerging Key Technology for Industrial Internet of Things

As mentioned earlier, several emerging technologies are creating the right conditions for the adoption of IIoT solutions, including 5G, edge computing, artificial intelligence and analytics, robotics, blockchain, additive manufacturing and VR/AR. Worth mentioning is the digital twin, which can be defined as a virtual representation of a real-world entity or process. With software simulating real-world "stuff" and real-time sensor data, engineers can prevent potential problems and use simulations to optimize performance.

In Gartner's 2018 Hype Cycle for Emerging Technologies, digital twin technology sits firmly at the "peak of inflated expectations," so it's worth looking at some of the current research.

Digital marketing specialists Reboot Online analyzed data from research agency Catapult on digital twins. Catapult's information comes from a survey of 150 engineers and is reported in more detail in its report, The Feasibility of Immersive Digital Twins: A Definition of Digital Twins and a Discussion of Immersive Benefits.

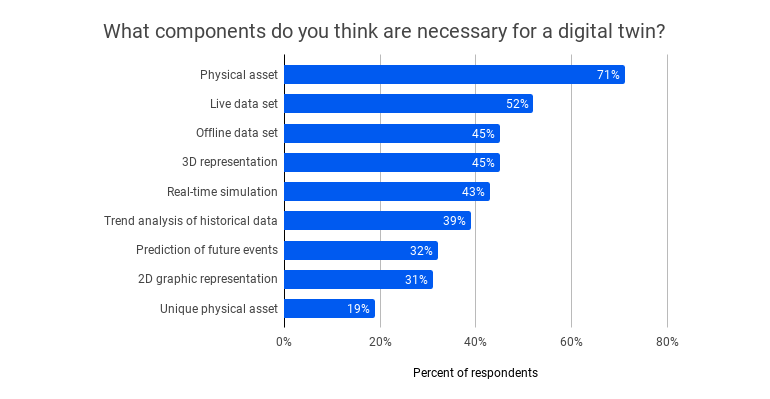

According to the engineers, the key components of a digital twin are physical assets, real-time and offline datasets, 3D representations and real-time simulations:

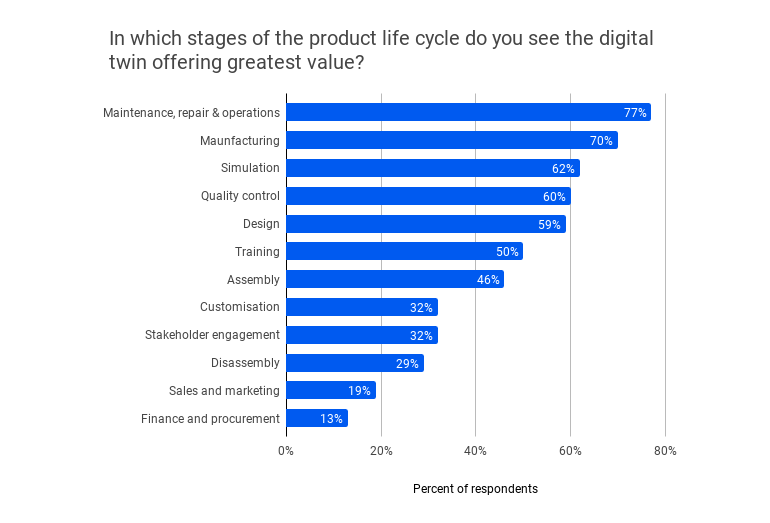

When it comes to the value of digital twins in the product lifecycle, maintenance, repair and operations, and manufacturing are the clear leaders, followed by simulation and quality control:

"We are living in an era of rapid technological advancement. First and foremost is the rise and development of digital twins," Naomi Aharoni, managing director of Reboot Online, said in a statement.

"Because the technology is able to cover the entire lifecycle of a physical system, process or product, it provides businesses with a powerful analytical tool that can thoroughly assess key performance indicators and provide insights into where improvements can be made." The Long Term Looking at it, the experience and advice from the digital twin will drive innovation and the growth of various opportunities,” Aharony added.

outlook

Although many IIoT projects are still in the proof-of-concept or pilot stage, there are clear signs that they are moving toward full-scale production deployment. Relevant technical conditions have been met, investment decisions have been made, and the return on these investments will be predictable.

Author: Charles McLellan

This article is from a translation, if you want to reprint, please obtain authorization from this site first.