The 2B war between Meituan, Haidilao and Meicai

Author:Qin Guan Time:2020/10/04 阅读:9400

In 2020,Food supply chain battle to the midfield, The undercurrent surged.

A group of food supply chain start-up companies that started 5 years ago have disappeared, and the rest are justMeituan Kuailu,Haidilao Shuhai,Mei CaiPlayers of such a large enough size are confronted in the rivers and lakes.

It is reported that Meicai has been adjusting its structure and optimizing its personnel on a large scale recently, in order to fight its last battle for the listing plan. After the departure of former Lenovo executive Chen Xudong, Kuailu was supervised by Wang Xing’s wife, Guo Wanhuai, who used defense as an offense and recruited troops on local battlefields in some cities to secretly seek survival. Shuhai completed its A-round financing last year with a valuation of US$2 billion and plans to list on A-shares in the future.

and they,Without exception, they are all telling a story of becoming a Chinese Sysco.

If you look at the list of the world's top 500 in 2019: 17 companies such as Walmart (1st place) and Costco (35th place) are shortlisted in the retail industry; there are two giants in the fresh food industry - Sysco of the United States (172nd place) ), Germany's EDEKA ZENTRALE (304).

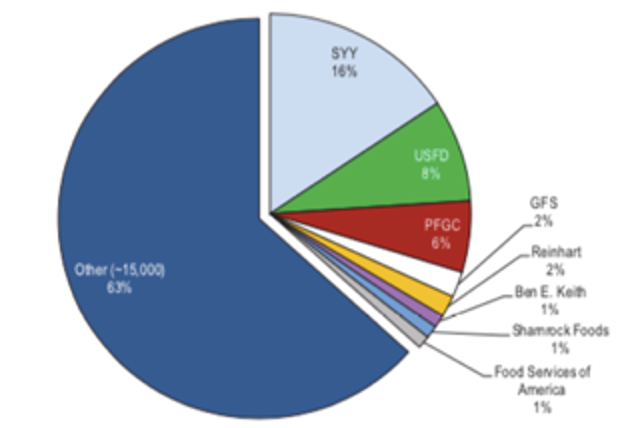

It is worth noting that Walmart only accounts for 10% of the U.S. retail market, while Sysco occupies 16% of the U.S. market in the food supply chain field, and the second-ranked US food has a market share of 8%, leaving no more than 5%. Simply put, Sysco's leading position in the US market is more monopolistic.

Then you might as well use Sysco as a benchmark to discuss the current and future of China's food supply chain. In this article I try to answer two questions:

1) Why haven't you found an effective way to play?

2) To learn Sysco, what should I learn?

Let’s first reveal the advantages and disadvantages of Kuailu, Meicai, and Shuhai in the field of food supply chains one by one, and start with the analysis.

Fast Donkey: No Longer Dash

Wang Xing once said in an internal speech: "After the past 20 years of market-driven development, leadership-driven development and innovation-driven development have all been exhausted,A very important direction is the innovation of supply chain and to B industry. Let's look at the supply side. If reforms are to be made, what changes will be made and what changes can realize their innovation and change in efficiency and cost. "

To this end, in the spring of 2018, Meituan introduced Chen Xudong, the former president of Lenovo China and senior vice president of Lenovo Group, as the senior vice president of Meituan Dianping Group, in charge of the B2B business unit of the large retail business group. At the same time, Meituan launched Kuailu, aiming to establish a B2B platform for catering ingredients.

Chen Xudong graduated from Peking University and joined Lenovo in 1993. He helped Lenovo establish a channel network covering China, Asia-Pacific and Russia. For Lenovo, which lacks product and technical capabilities, channels are its core competitiveness. In the past, there was a saying that "channels are king", and Lenovo played channels to the extreme. Lenovo's channels are basically fully covered, making it achieve sales of 50 billion US dollars. This experience illustrates two problems: Meituan is interested in Chen Xudong’s tens of billions of dollars in business, and Meituan believes that it needs extremely strong channel capabilities to play with the food supply chain.

In addition to Chen Xudong, let’s take a look at what resources Meituan itself has to support it in this big 2B business:

1. Traffic:Meituan is the absolute leader in catering to C traffic. In general restaurants, the business brought by Meituan can be as high as 1/3, not to mention takeaway. At the same time, Meituan also has Zhangdan, a company that focuses on helping traditional catering companies operate online business on behalf of them, and has 20,000 catering customers. Through the traffic, Meituan has mastered the data such as the place where consumers spend, the dishes and the amount, and uses this to guide the traffic to different restaurants to obtain the highest discount points.

2. SaaS:The ERP link of catering companies is very weak, and it is impossible to coordinate the collection and delivery of ingredients without opening up. Therefore, Meituan acquired Pingxin Technology in 2018, a company serving small and micro catering, which has 2,000 local pushes and nearly 100,000 merchants. At the same time, Meituan invested in Aoqiwei, which specializes in providing customized Saas services to chain catering companies, with 16 categories of products and 100,000 chain stores. According to the "China Catering Report 2018" statistics, there are 8.6 million catering companies in the country, and Meituan has won 2.3% of enterprise data.

3. Purchasing:In terms of upstream categories, Meituan invested in the Asian Food Federation, which owns the Asian Fishing Port (shrimp and fish), and the Asian Fishing Snow Dragon (beef) is the main ingredient for catering. Its last round of investors was New Hope. Meituan also invested in Pocket Fast Retailing through Dragon Ball, and recently merged with Yijiupai to enter the distribution of Fast Retailing and alcohol.

The soldiers and horses did not move, but the food and grass went first. Meituan has a strong local promotion team, a large accumulation of IT and data, hundreds of thousands of catering customers, and the alliance of upstream categories, plus Chen Xudong's 20 years of product distribution experience, to create a tens of billions of ingredients distribution Enterprises can't be said to be riding the wind and waves, but also should be a matter of course.

After all, Meicai, which also focuses on the purchase of small restaurants, has a revenue of close to 20 billion in 2019.

Following Meicai's example, Kuailu began to build a large warehouse. The catering owner places an order on the mobile app, and rice noodles, grain, oil, water, beverages, and vegetables are delivered to the door. With its strong ground capabilities, this new business currently covers 21 provinces and 38 cities across the country, with an annual active merchant count of approximately 450,000. As of October 2018, the monthly sales of Kuailu's purchase business exceeded 400 million.

However, 14 months after joining the company, Chen Xudong resigned, and Kuailu began to shrink. Industry insiders estimate that the loss of Kuailu is estimated to be nearly 1 billion.

At the same time, Meituan's Wang Huiwen said something, which can be seen as an explanation for Kuailu being hit by the brakes: "It is often easy to overestimate the change in one year and underestimate the change in five to ten years.In fact, when the consumer Internet and the industrial Internet are combined, the impact of this time should be emphasized, because in the past few years,The consumer internet is growing very fast, such as WeChat, has become a behemoth in a very short period of time.However, the speed of change in the industrial Internet is very slow, because the industry often involves heavy assets, investment, and changes in consumer behavior are very slow, so when these two things are combined together, it is not actually a combination of speed and slowness, but also because of the resulting organisms , operating methods, cultures including values, etc. are completely different, so the combination of the two will create a lot of difficulties. "

What is meaningful is that Tencent arranged for Wang Huiwen to give a speech on the theme of "Convergence of Consumer Internet and Industrial Internet". After finding it difficult to integrate the two, Wang Huiwen's speeches were all about takeaway, and it seemed that he was unwilling to talk more about this topic.

In January 2019, to C's "Meituan Shopping" was launched in a low-key manner, participating in community group dishes. When everyone thought that Meituan was shifting from the industrial Internet to the consumer Internet route, Kuailu actually did not stagnate, but stopped making rapid progress. However, this business has not yet found a new operator.

Meicai: Building 2B Internet with 2C Internet

Meicai is one of the most radical experimenters in the 2B industry of 2C Internet. As an old enemy of Meituan, the last company founded by Meicai founder Liu Chuanjun, 55tuan, was tied with Lashou and Meituan as the top three group buying giants. However, after being defeated by Wang Xingqian in 2014, Liu Chuanjun chose to start a business and entered the e-commerce of agricultural products and founded Meicai.

Only 4 years later, the two played against each other again. At this time, Meicai’s annual revenue had reached 18 billion, and the monthly active service restaurant exceeded 1 million. When Meituan went public, Hillhouse Capital, a shareholder of Meituan, and Tiger Fund invested US$600 million in Meicai, with a rumored valuation of nearly US$8 billion.

Liu Chuanjun's background decided,Meicai actually uses the routine of consumer Internet companies to do food supply chain business.

The so-called consumption Internet routine refers to, through subsidies for each order or advertisements full of elevators, so that urban young people download new apps and place orders continuously. Behind every purchase is a huge push. Under the law that the second child must die in the consumer Internet, leaders can slowly but freely reduce subsidies to consumers, or increase deduction points for merchants. In the end, in a new consumer market, the platform obtains huge monopoly profits.

Has Meicai proven that its business model is feasible?

Before answering this question, I would like to talk about the three stages that the Internet usually goes through when changing traditional industries:

The first stage:Internetization of information, The onlineization of information makes consumers understand information faster. Such as Sina News, Autohome;

second stage:Internet of operations, through SaaS to connect the upstream and downstream in the industry to improve transaction efficiency. Such as Souche and second-hand car dealers, Ctrip and hotels;

The third phase:Internet-based business, The Internet has deeply transformed the physical industry and changed the original business model of the entity. Such as Didi and Kuaiche, Ali and sellers.

The first phase created many of the existing Internet giants. Since the excess of VC funds in 2014, many start-up companies have been working towards the second and third stages. Usually after financing, most companies can complete the second stage and achieve a small-scale break-even. But there are very few survivors in the third stage, because the cost and speed of changing the physical industry are much slower than expected, so huge losses will be generated. SoftBank Vision Fund lost more than $2 billion on Wework. It is rumored that Meicai’s annual loss is as high as 2 billion RMB.

So why did Meicai make such a big loss?

1. The efficiency of traditional industries has reached a certain level and it is difficult to improve. Not only no promotion, but also no value and no gross profit.Industrial Internet to B practitioners are familiar with each other. QQ or WeChat is already a means of daily communication, and the efficiency of mutual transactions is already very high. Even if the ERP of different industrial links is connected, the efficiency improvement is limited. The willingness and amount of payment of the bosses are very low, which leads to the poor life of SaaS in various industries, even if the scale of profit is not large. The supply chain of fresh ingredients is long and there are many types, and it is rare to do a good job of ERP in one link, let alone get through it.

2. Users in traditional industries are sensitive to prices and the cost of migration is extremely low, so they cannot cut wool.Subsidies and advertisements can occupy the minds of consumers. If you want to eat hot pot, you must buy Wanglaoji. Consumers are not sensitive to price, but the cost of migrating to different platforms is high. For a restaurant owner, the only thing that matters is the price. Wanglaoji on the platform is cheaper to buy from you, and others are purchased from familiar wholesalers. Except for just-needed commodities such as cigarettes and beer, other commodities simply cannot bind small bosses. Even if the overlord fights hard, first monopolize and then increase the price to harvest. Meicai’s revenue in 2018 was 18 billion, which is only 1/5 of the scale of Beijing Xinfadi.

3. The cost of the industrial Internet is higher, and one order pays one order.Scott said that the value of a company lies in the fact that transaction costs within the company are lower than those in the market. Fresh ingredients are characterized by many SKUs, high timeliness, and large price fluctuations, making their organization and management extremely difficult. For example, coriander is usually 3 yuan/kg, and the purchaser said that it was 6 yuan/kg today due to the heavy rain in the south yesterday. Does the headquarters agree or agree? The agency problem under the company will lead to widespread corruption.

Unable to improve efficiency to create value and make money, unable to overlord to steal money, inefficient operating system + corruption will inevitably lead to large-scale losses.

The rapid growth of Meicai is based on the rapid expansion of the primary capital market in the past few years. The bolder the financing, the easier it is.

Shu Hai: Can an efficient operating system be replicated?

Start-up companies have to go through hurdles such as cold start and C-round death, while the independence of internal departments of large companies also has three major hurdles-internal market-oriented transactions, external services and independent financing, and relying on external customers to survive:

The first step is to turn your procurement into an independent supply chain company and establish a nationwide warehousing and logistics system;

The second step is to use the existing logistics system and procurement capabilities to serve external customers, as long as they do not lose money, they earn money;

In the third step, the scale of external services is getting bigger and bigger, making Sysco of China.

Shuhai was established in 2009 and began to serve external customers in 2016. The completion of financing in 2019 shows that the first two hurdles have almost passed.

Shuhai is backed by Haidilao, which has a revenue of 17 billion and 466 stores. It has established centers in more than 10 first- and second-tier cities to provide logistics delivery services, and there are more than 10 central kitchens/factories specializing in food design and processing. , such as crispy hairy belly, liquid nitrogen bullfrog, etc., to obtain high gross profit.

Secondly, the products sold by Shuhai cover the main Chinese food ingredients, and the proportion of hot pot ingredients in the income of external customers is very low. In 2018, Shuhai's revenue exceeded 3 billion yuan, and its valuation reached 2 billion US dollars.

Compared with Sysco, if Shuhai wants to become a successful food supply chain enterprise, it needs to establish three strong core capabilities:

1. Sufficiently wide product line

In fact, the fresh food industry is divided into two subdivisions: one is suppliers with a wide product line, accounting for 37% of the market; the other is distributors specializing in certain categories, accounting for 63%.

Foreign fresh food giants all have a very wide product line and their own brands of 30~40%. For example, Top 10 companies such as Sysco in the food industry only account for 30% of the market, but this is basically all of the wide product line market. The remaining 15,000 are basically distributors specializing in boutiques. The same similar pie chart can be seen in foreign auto parts and MRO fields.

The crispy tripe and liquid nitrogen bullfrog developed and produced by the central kitchen that Shuhai is proud of are just some kind of specialized products. Under the temptation of such high gross profit, will Shuhai invest its limited resources in asset-heavy central kitchens and factories, or spend great efforts to establish a standard product supply capacity of 5~8%?

2. Procurement bargaining power generated by a sufficiently large purchase volume

Shuhai is concentrated in first- and second-tier cities, where there are strong wholesale markets and distributors. The strength of the wholesale market cannot be overemphasized.

In the past, due to the shortage of commodity supply, China’s commodity circulation first satisfied the first- and second-tier cities, and then the third- and fourth-tier cities. Therefore, the entire circulation chain formed factories—powerful wholesale markets in provincial capitals—and secondary wholesale markets in third- and fourth-tier cities. circulation system. In the chain catering industry, a few main categories can be purchased directly from factories, but a large number of vegetables and other auxiliary materials still need to be purchased by buyers in the wholesale market.

Although the purchase volume of Shuhai is large, it is scattered in every place and every category. For the wholesalers/bookmakers of upstream categories, it has no advantage. Even if Shuhai's procurement volume has increased by 10 times, it may not be able to form a centralized procurement advantage in bulk varieties such as meat and fruits worth hundreds of billions of dollars.

3. More efficient cargo circulation efficiency and logistics efficiency

The efficiency of goods circulation is limited by the scale of transactions, and it is difficult to improve in the short term. But logistics is decentralized, transparent and difficult to manage. If there is no efficiency, it will only lose money. Behind the service catering business are countless small companies. The characteristics of these small companies are as follows:

a) dispersion: China's cold chain is 100 strong, excluding the logistics companies of large processors, basically 100-200 million can be ranked in the top 20. No third-party company dares to say that it can do a good job in national business.

b) transparent: The delivery service in various places is very transparent. It is very easy to calculate how many times a car runs a day and how many points are delivered. It is difficult for anyone to establish an advantage.

c) unmanageable: National warehousing and distribution is a difficult management problem. There are many types of goods in various places and different customer requirements. Now it is all managed by people, which is why there has been no national cold chain company. If there is no advantage in this area, there is no way to pull more other suppliers into the warehouse, form a joint distribution, and ultimately greatly improve efficiency.

(Co-allocation: That is, two suppliers send two cars to a restaurant, it is better to send them together. Choosing a first- and second-tier city to carry out business will also increase the difficulty of co-location in disguise. Customers can choose too many storage and distribution resources.)

Shuhai chooses to exempt warehouse rent, that is, subsidies, to obtain warehouse management services from large suppliers. However, Shuhai did not invest in warehouse management and IT system construction on a large scale, making its logistics level no different from other small logistics companies.

Where is the way?

After analyzing Kuailu, Meicai, and Shuhai, we found that if we condense the main points of fresh food B2B into three points—establishing a wide product line, creating a price advantage in centralized procurement through category operation, and improving the efficiency of the entire supply chain, we will find a The main contradiction is that no single company can achieve these three points at the same time, it is impossible to have a large enough volume to replace all market participants, and its own efficiency cannot be higher than the market, soUnable to form a centralized procurement advantage.

Does that mean that there is no hope of growing giants in the food supply chain field in the Chinese market?

If you carefully study Sysco or NAPA, the American auto parts 2B giant, you will find that they actually use a company form similar to an alliance.

The alliance organizes all small and medium-sized participants (traders) to form a wide product line and centralized procurement advantages, and returns the discounts of centralized procurement to small and medium-sized participants to make them competitive. That is, the distributors and logistics companies characterized by mom-and-pop stores are transformed into corporate-like efficient and cooperative operating entities, while retaining the enthusiasm and flexibility of self-employment.

Here are a few key breakthrough points:

The first level is supply chain finance.

In addition to the need for several core members in the initial stage and the support of capital, the most important thing is supply chain finance. By reducing the capital investment of small and medium-sized traders, their input-output ratio can be greatly increased. Take NAPA in the auto parts industry as an example, small dealers can apply for $1 million inventory financing. The requirement is that the proportion of self-owned funds is not less than 30%, and all inventory products need to be purchased from NAPA. NAPA can exchange all stocks for NAPA products within 2 days.

The second hurdle is to gather the existing small B to form the advantage of centralized procurement.

The alliance does not mandate that small and medium-sized distributors purchase goods from themselves, and they can also purchase from outside. The alliance will negotiate with suppliers on the priority purchase right of a certain category, and then gradually expand to centralized procurement after collecting the quantity. For example, Sysco negotiates with suppliers on the priority purchase right of certain specifications of beef to ensure the stability of supply and calculate demand. When purchasing beef of this scale, small and medium-sized dealers must purchase in the name of the alliance, and other categories can purchase by themselves.

The third hurdle is to invest in the link with the largest scale effect to improve the efficiency of everyone.

The focus of the alliance is to invest in the development of warehousing and IT systems. The core purpose is to better help small and medium-sized dealers manage inventory and reduce the amount of inventory. At the same time, the soundness of the WMS warehouse management system and the TMS transportation management system can also better enable small and medium-sized dealers to serve end customers with a unified standard, and provide consistent low cargo damage and high time-effective delivery for chain customers. The most important thing is Warehouse distribution and IT systems are both heavy assets, and it is not economical for all participants to do it themselves. This is why Tongda’s express delivery headquarters controls distribution and IT.

# If you want to have a better understanding of Sysco's business model and profit model, unlockTiger Sniff Member, you can get "Supply Chain: Demystifying the Vital Gate of Giants"column, which specifically talks about how Sysco was established and grew.

Above we analyzed the business logic of 2B, and the most critical financial logic behind it is cash flow.

2B is an industry with low interest rates, so the key to whether a company can grow bigger is the need for positive cash flow. Support the company's continuous investment in working capital and heavy assets through growing cash.

Business income = cash required for operations * turnover times * cost rate. The larger the scale, the more operating funds need to be invested. If the increased profits (EBITDA) cannot be covered, continuous financing is required to continue.

It is very difficult for 2B companies such as fresh ingredients to obtain cash flow, which is why start-ups for fresh ingredients have negative cash flow. Downstream 2C retail companies face consumers and can naturally obtain cash flow. Upstream brand manufacturers use their brands to capture the minds of consumers. The rate is also positive cash flow.

In this situation of being blocked at both ends, China's fresh ingredients have developed a chain of collective advances. The whole chain: restaurants——Third-tier dealers——second-tier dealers——first-tier dealers—Brokers—Farmers—Agricultural materials dealer, the bold links in the middle all need to advance funds.

To put it simply, China uses its own accumulation to provide funds for the entire industry through countless dealers of agricultural products and agricultural materials. Therefore, the entire industry is forced to divide into multiple links and many subjects to share.

Then why do the two giants in the foreign food supply chain, and even the leading 2b distribution companies in other industries have positive cash flow and a large scale? Where is their source of cash flow? Basically, its sources can be divided into three categories: savings, credit and capital markets within the industry.

Taking auto parts as an example, A-share parts and components listed companies have advanced 235.5 billion in accounts and inventory for automakers, of which 128.2 billion is owed to the upstream, 137.5 billion is borrowed, and 69.4 billion is raised from the listing, a total of 335.1 billion. Among them, sufficient cash flow has created large-scale parts and components companies to enable them to obtain financing through the capital market. The first-tier parts supplier will owe the second-tier, and the second-tier will owe the third-tier. Therefore, for the entire industry, borrowings and accumulated profits are the most important sources of funds.

The chain of the U.S. fresh food industry is restaurants-Sysco-food processors-farms, and there is no multi-level apportionment system like the automobile industry. But except for the farm, everyone else is cash flow positive, where does the money come from?loan!

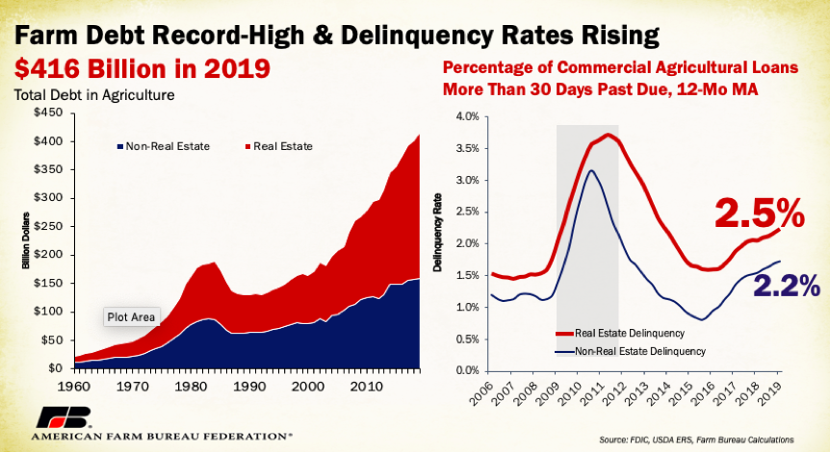

The total amount of farm loans in the United States in 2019 was 416 billion US dollars, and the annual output value of the entire US farm was 389 billion, of which grain and poultry meat accounted for half and half. Simply put, the cash flow of all companies downstream of American agriculture is actually supported by loans.

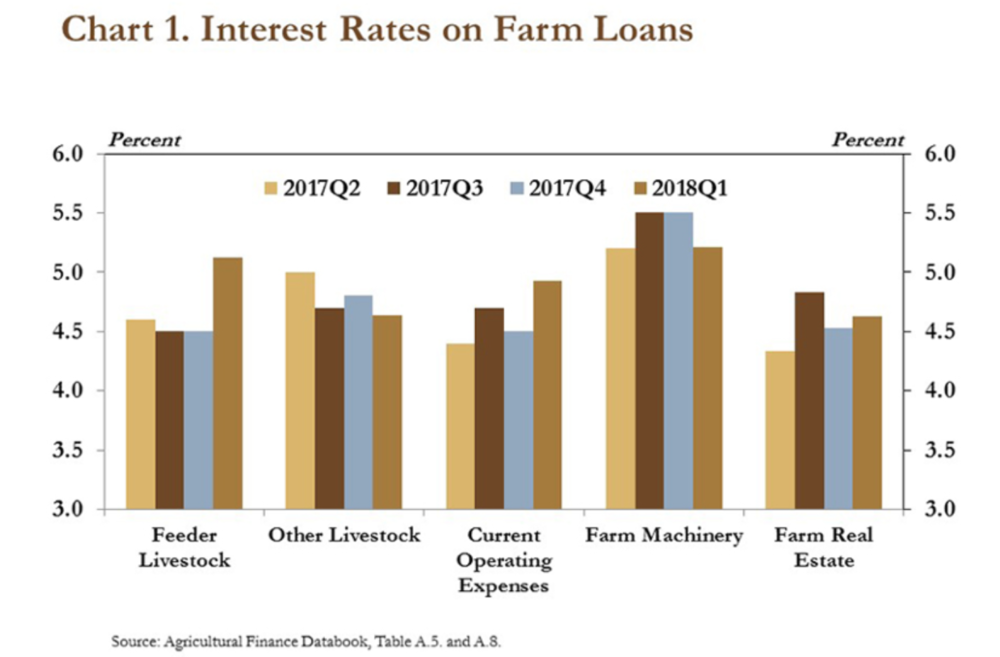

But this is not the end. Two-thirds of American farm loans are land mortgage loans, the overall mortgage rate is about 1.5% off, and the bad debt rate is 2.2~2.5%. The United States has reduced the cost of credit access by capitalizing and circulating rural land. This is the biggest difference from China, where rural land has not yet been formally circulated.

The capitalization of land will lead to a substantial increase in land concentration. Farms need to continuously invest in new machinery and technology to increase production and reduce costs. Agriculture has become capital-intensive, which has eliminated a large number of small farms. Rural land capitalization occurs in developed countries all over the world, because agriculture is the first industry to compete globally.The more concentrated land means the lower the price of agricultural products, which is why the price of pork and beef in the United States is so low.

The advantage of land capitalization is that it can greatly reduce the cost of loans. The interest rate of agricultural commercial loans in the United States is around 4.5%. China's rural land assets are mortgaged, and banks need to assess the risks of farmers and dealers. However, the lack of centralized rural areas, the weak ability to resist risks, and the high cost of loan coverage make the cost of bank credit higher. Only small loan companies such as CreditEase enter, and the capital cost is 15~18%. The high interest rate of microfinance is also a good thing. Yunus also won the 2006 Nobel Peace Prize for his creation of rural microfinance.

From this point of view, for China's fresh food market industry, what is the way to break the situation?

After all, the lack of external loans is a problem that all 2B companies in scattered small and chaotic industries have to face.

We said earlier that cash flow comes from: savings, credit and capital markets within the industry. China's credit institutions look at the background first, and the real estate second. Therefore, the main flow is high-credit enterprises (state-owned enterprises), and a very small amount enters the circulation industry through factoring ABS, which corresponds to the accounts receivable of high-credit entities.

Therefore, credit cannot be counted on, capital ebbs, and the only way out is the savings in the industry.Therefore, if the fresh food industry wants to develop as a company, alliances are the only way to go.