24 industrial Internet companies raised 2.36 billion yuan in 9 months, and the amount of financing increased by more than 65 times in three years

2020 can be said to be the "big year" for the industrial Internet. At the beginning of the year, with the support of new infrastructure policies, the Industrial Internet triggered widespread discussions. At the same time, with the "difficulty in starting work" caused by the epidemic, the industrial Internet has catered to people's needs for new "online, unmanned, and intelligent" production and manufacturing models.

Digital and intelligent transformation in the industrial field has become a consensus, and the capital market is also accelerating the layout of this field. This year, large-scale financing has continued in the industrial Internet field. Haier's Kaos Industrial Internet Platform has completed two rounds of financing in a row, with a total financing amount of over 1 billion yuan. TCL's Gechuang Dongzhi, Xuelang Digital System, Shanghai Huicheng, Cloud Factory and other companies have also completed over 1 billion yuan. yuan financing.

The Industrial Internet cannot be regarded as an industry, it is more of a concept. Enterprises under this concept have their own characteristics in various aspects such as downstream markets and business models, and their investment cases cannot be summarized using general industry investment logic.

In order to explore the potential patterns behind investment events, we analyzed the characteristics of investment and financing in this field based on investment and financing cases in the industrial Internet field in recent years. The following case statistics are based on the Whale Insight Database as the main source.

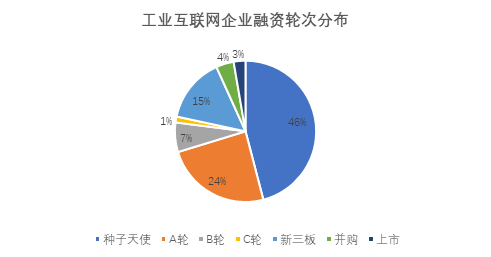

- Financing rounds are generally concentrated in seed rounds and A rounds. B and C round cases have only begun to appear in the past two years.

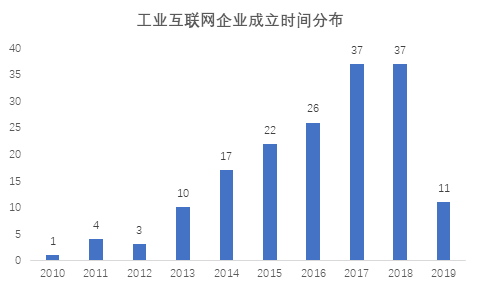

In 2012, the concept of "Industrial Internet" was officially proposed. Since then, the number of newly established industrial Internet companies has increased steadily and reached its peak in 2017. From 2015 to 2018, the number of newly established companies exceeded 20 every year. In fact, the industrial Internet companies that are currently active in the market, such as Xuelang Digital System, Shanghai Huicheng, Gechuangdongzhi, Mushroom IoT, and Qiyun Technology, were all established in 2015-2018.

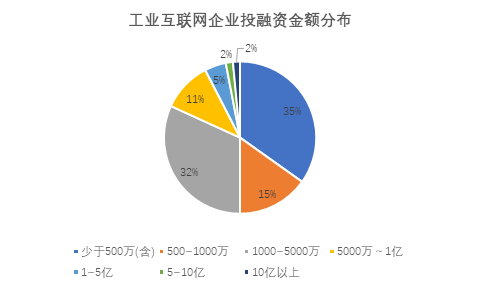

Judging from the financing amount, at this stage, the financing amount of enterprises is mainly concentrated in the two ranges of less than 5 million yuan and 10-50 million yuan, which is also in line with the distribution of financing rounds of industrial Internet companies. We screened 74 companies with traceable financing paths, and statistics found that the current financing rounds of industrial Internet companies are still in the seed round or A round, and the proportion of companies in the seed round and A round reached 70%.

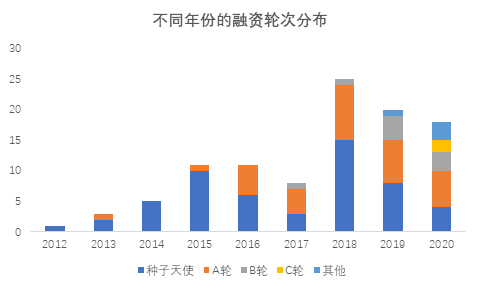

However, compared with before 2017, B and C round financing cases have also increased significantly in recent years.

- The number and total amount of financing cases have skyrocketed in the past two years, with segments such as energy and power, semiconductors, and electronic assembly being the most popular.

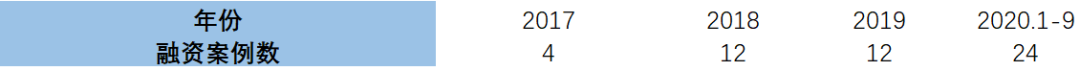

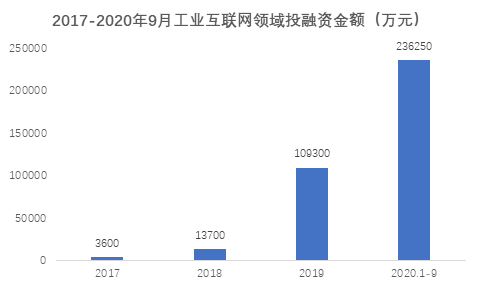

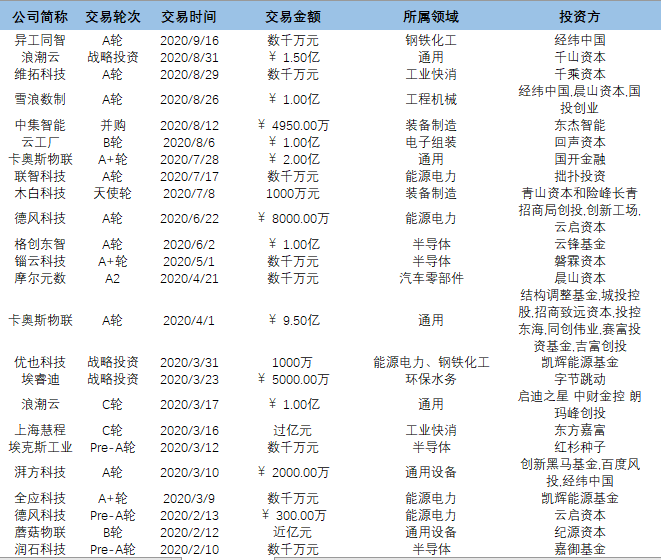

In order to have a clearer understanding of the characteristics of industrial Internet companies currently receiving financing, we used a total of 52 financing cases from 2017 to 2020 as samples to study the characteristics of their company models, downstream industries, and investment institutions.

We found that from 2017 to 2020 to the present, the number of financing cases and the total amount of financing have increased rapidly.Compared with the 4 financing cases in 2017, there have been 24 financing cases so far in 2020, with the total financing amount reaching 2.36 billion yuan, an increase of 65 times compared with 2017.

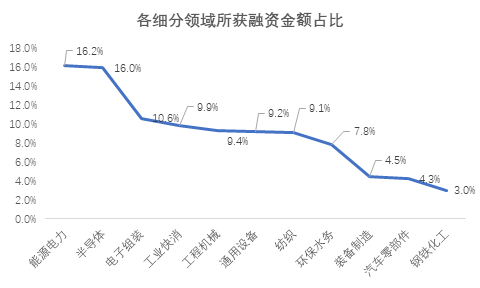

According to the size of the financing amount, the proportion of funds received by general-purpose platforms reached 64%, and only 36% of funds flowed into non-universal platforms, solutions and segmented applications. Continuing to track the whereabouts of the 36% funds, we found that the three subdivided fields of energy and power, semiconductors, and electronic assembly attracted more funds than other fields.

It should also be noted that many industrial Internet companies span multiple fields. For example, some companies also provide solutions for process industries such as energy and power, steel and chemicals, and semiconductors often appear at the same time as LCD panels, electronic communications and other fields. Here is a rough classification based on the company's main line of business and the main sub-industries.

The proportion of investment and financing in subdivided fields is greatly affected by large-scale financing in this field. We have counted the cases of financing exceeding RMB 100 million in the industry in 2020, and there are a total of 8 cases, namely:

Note: Financing of “over 100 million yuan” is calculated based on the financing amount of 100 million yuan.

Comparison shows that general-purpose platforms are still the gathering place for large-scale financing, and financing of more than 100 million yuan in other subdivisions has become the main driving factor for the high proportion of financing in the energy and power, semiconductor, and electronic assembly fields.

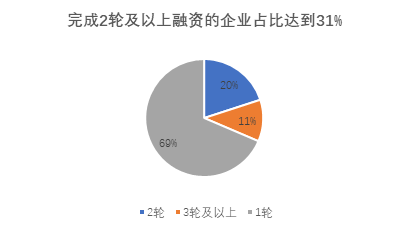

At the same time, in addition to large-scale financing cases, several companies have recently completed two or three rounds of financing. Our 52 sample cases correspond to a total of 35 industrial Internet companies. Among these companies, 31% has received 2 or more rounds of financing.

- Many investment institutions have frequently made moves in this track, and state-owned and industrial-backed funds have been active.

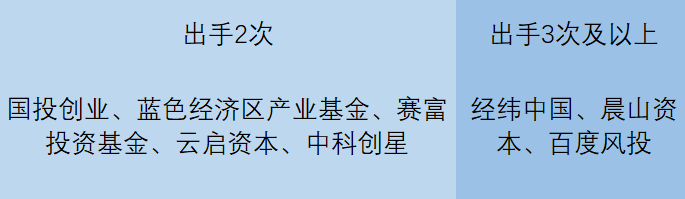

In terms of investment institutions, there are also many institutions that have continuously made bets on the industrial Internet track, with the number of investment cases being two or more. The statistics are as follows:

In addition, as a component of "new infrastructure", the industrial significance of the industrial Internet is self-evident, and state-owned and industrial-backed funds are also frequent visitors in financing events. Our statistics found that out of 52 cases with a total financing amount of 3.63 billion, the financing amount of cases involving state-owned and industrial backgrounds reached 2.2 billion, accounting for 61%.

In the past, industrial Internet companies were often criticized by the capital market for reasons such as heavy models, poor replicability, and unclear business models. However, precisely because of the heavy model and high degree of customization, it is easier for companies to build competitive advantages in segmented fields. Judging from the market size, customers' willingness to pay and ability to pay, the industrial field also has the soil to cultivate "unicorn" companies. Taking advantage of the digital transformation of the entire industry, domestic industrial Internet companies are expected to usher in a new wave of growth, and accordingly, the capital market will not be absent. From the currently common “seed round” and “A round” to the future “B and C rounds”, and even public listings, there is still huge room for growth in the capital market in the industrial Internet field.

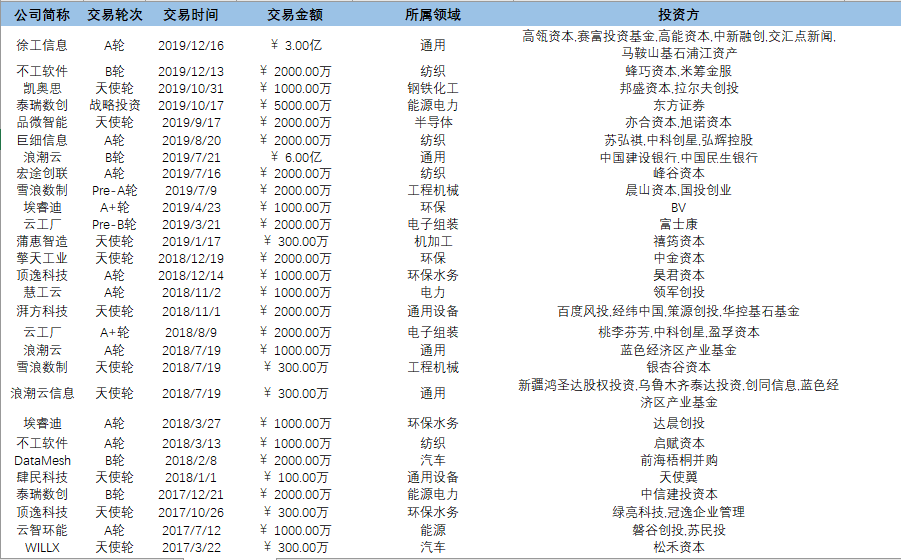

Appendix: 52 industrial Internet investment and financing cases from 2017 to 2019

Author: Dong Luyao